Intro

The balance sheet takes a snapshot of the company’s financial situation at a specific point in time. One of the company’s financial statements, it accompanies the income statement and cash flow statement by showing the company’s assets, liabilities and shareholder equity. With the formula below showing how assets equal the sum of liabilities and shareholder equity.

Assets = Liabilities + Shareholder Equity

The balance sheet is essential for showing what the business owes and is owed, with the figures being used for fundamental analysis and producing key ratios. Although the never-ending rows can be intimidating, only a few figures are necessary for producing these formulas.

Definitions

Current Assets: Cash and other assets that are expected to be sold or used within one year. These include cash, cash equivalents, accounts receivable and inventory.

Non-Current Assets: The long-term investments of a company where full value will not be realised within one year. Examples include property, plant and equipment (PPE), intangible assets and goodwill.

Current Liabilities: A company’s short-term financial obligations that are to be paid within the year. These include current debt and accounts payable.

Non-Current Liabilities: A company’s long-term financial obligations that are not to be paid within the year. Examples include: long-term loans and deferred revenue.

Shareholder Equity: Also known as stockholder equity, it is equal to a company’s total assets minus its total liabilities. It is the share capital of the firm and its retained earnings over time through operations.

Current Assets

Current assets are essential because it shows how liquid (cash-rich) the company is. Without this, there is no way to ensure the company has enough to pay short-term liabilities. Using the current ratio you can work out how able the business is to pay creditors in the short-term, under one year, over 1.5 is good, but 2 is better. It’s also important for that cash to go somewhere, this could be in the new investment opportunities or dividends.

Another test using the current assets is the acid-test ratio, also referred to as a quick ratio. It shows the ability of a firm to pay off current liabilities, similarly to the current ratio, however it doesn’t include inventory within the calculation due to its difficulty to liquidate. A ratio of under 1 may mean the business doesn’t have enough current assets to ensure payment of current liabilities. Although it is important to note inventory intensive companies may be thriving at under 0.5.

Current Ratio = Current Assets / Current Liabilities

Acid-Test Ratio = (Current Assets – Inventories) / Current Liabilities

Non-Current Assets

The worth and quality of assets demonstrates a company’s stability, safety and in some cases the increase in share price potential. The non-current assets such as the PPE and intangible assets in most cases make up a substantial portion of the company’s assets. By taking all assets minus all liabilities you derive the book value which can be used to set the lowest level for estimating a company’s intrinsic value, P/E ratio sets the upper limit. With a price to book value of 1.5 or below is preferable.

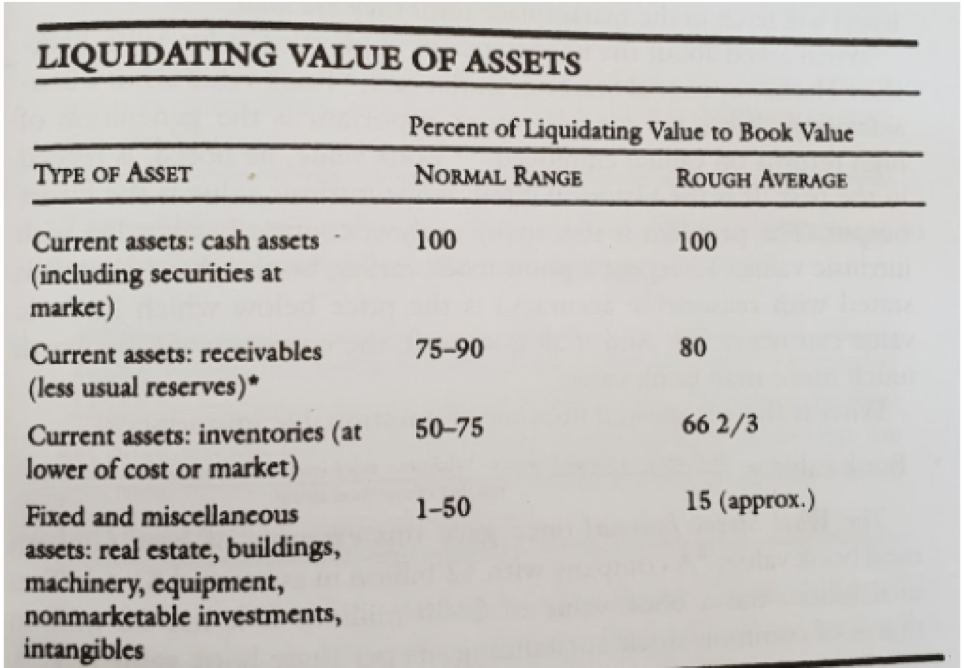

Assets can also be used to find the liquidation value of the firm. This process isn’t quite so simple as taking the assets minus the liabilities and would also change if the company were to sell tomorrow in a flash sale or winding down business. Although the balance sheet is less dressed up than its income statement counterpart, adjustments still need to be made to give a fair reflection of what’s being presented to get the liquidating value of assets. Liabilities can be largely held at face value and current assets such as cash can also be held for full value. Other current assets and non-current assets must be adequately adjusted as shown in the table below. For conservative valuation intangible assets are excluded, goodwill can also be excluded altogether as it’s the extra a company pays when acquiring another.

Using this table you’re able to find the liquidation value of the company if it were to sell today – a powerful tool in deciding when to purchase a piece of a company.

It’s also important to mention tangible ‘hard’ assets and intangible ‘soft’ assets. Although valuing tangible assets can be easier using amortisation and depreciation, intangible assets are nearly impossible to price. This does not mean that they aren’t important, in these modern companies assets such as patents and trademarks fall under this category of ‘soft’ but essential assets. They need to be factored in, but valuation is often overly inflated on the balance sheet.

Current Liabilities

Being the short-term financial obligations of a firm, it’s essential that these are paid for a business to be able to stay afloat. As previously stated a current ratio of 1.5+ is as to know the company can make payment, but it’s important to remember the balance sheet only gives a reflection of the company at a certain period in time and in a few weeks this position could also change.

Non-Current Liabilities

Debt is important because it cuts into assets and earnings but also plays an important role in funding corporate growth. Leaving the question to investors, once the debt is taken care of, is there enough cash left to perpetuate the business? A simple measure of this is the debt to equity ratio that should approximate 50% (or 0.5), with a big stretch being 55% in debt to total capital. For more conservative investors the ratio should be no more than 0.5.

A useful gauge at a company’s credit level is its classification from rating agencies. Standard and Poor’s, Moody’s Investors Service and Fitch’s Investor Service all offer their ratings on a company’s bond rating, from AAA (highly unlikely to default on loans) to D (highly likely to default). You want a company that is unlikely to default as it means it’s able to sort its debt.

Shareholder Equity

As shareholder equity is simply total assets minus total liabilities, the result would be positive or negative. Positive is preferred as a negative result would indicate a more risky investment. The shareholder equity can also be used to calculate the return on equity (ROE), which can assess how much is being given back on an investment and the growth rate of the company. When investing you want a company whose ROE is at the industry average or better, with each industry the average ROE will be vastly different.

ROE = Net Income / Shareholder’s Equity

Summary

Overall, the balance sheet offers valuable insights into the assets and liabilities of a firm. A huge amount about the firm can be inferred through basic formulas but it’s important to be aware of dressed-up items. The general message is that the more assets compared to liabilities the better and if a company is in trouble, it’s up to you to find out whether those troubles are temporary or permanent.

Other useful links: